A sole trader is probably the simplest and lowest cost of the business structures. As a sole trader you are responsible for all aspects of the business - including any profit the business may make, but also for any debt or losses. If your business becomes insolvent, then you can be personally liable

Incorporated Associations: What are they?

In Australia, there is close to a million not-for-profit organisations. These organisations come in various forms and sizes. A common type of not-for-profit organisation is an incorporated association, and these are set up and managed by the laws of each state or territory. You may also come across

Do I need a Company?

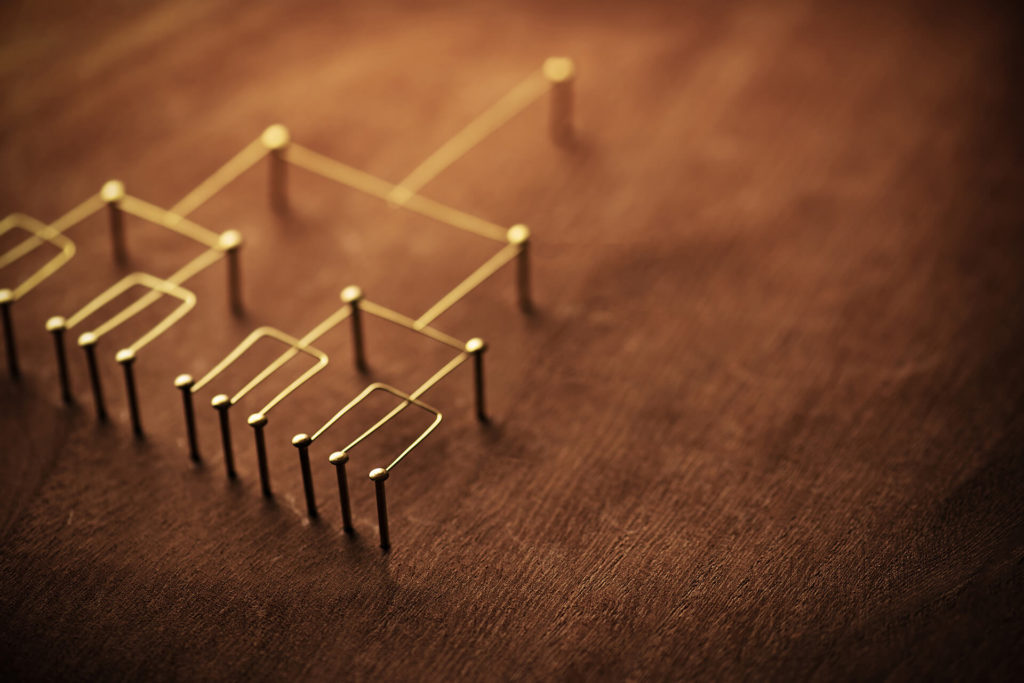

Often, one of the last things that a person thinks about when kicking off their business is how they will legally operate – for example, either as a sole trader or through a company. Business structures can take a variety of forms. The most common types of business are companies, body corporates

Funding Options for startups / how do I raise capital?

No matter the idea, getting the initial capital needed is pivotal. Generally, your business capital comes from your own hip pocket. But, in some circumstances this might not be achievable. This means that to establish and grow a business, you will need a little - or a lot - of cash to execute your

Licensing: Profiting from Your Assets Without Selling Them

Is your business thinking about selling off assets to boost cash flow? Are you sitting on a valuable idea or asset that could be making money but for whatever reason you don’t have the ability to make the most of it? Thinking about whether your asset can be licensed in a way that benefits you,